Our GST API suite streamlines end-to-end tax operations by enabling real-time GSTIN validation, automated e-Invoice (IRN) generation, seamless e-Waybill processing, and instant access to filing, payment and return status — eliminating repetitive manual tasks and reducing compliance risks for fast-growing businesses.

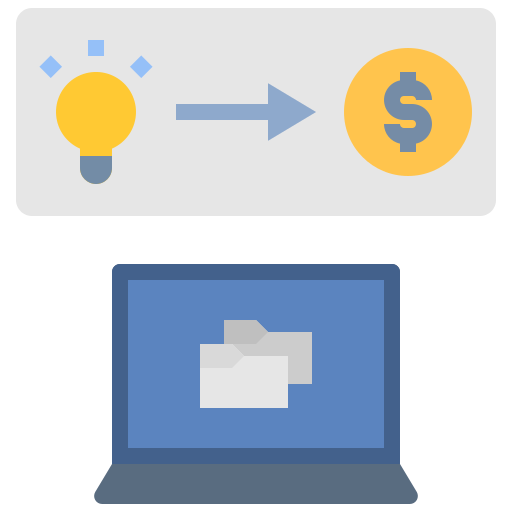

Designed for ERPs, billing solutions, accounting platforms, marketplaces and fintechs, the API ensures secure, GSTN-compliant data exchange with audit-ready logs, bulk processing capability, webhook-based status updates and reconciliation support for GSTR 1, 2A/2B & 3B — enabling faster reporting cycles, improved accuracy and lower operational overheads.

Whether you're onboarding thousands of vendors or managing high-volume invoicing, our GST APIs help accelerate digital compliance, minimize errors, and offer scalable integration for both enterprise and SMB use cases.

Automate tax tasks, reduce filing errors, speed up reconciliations and ensure GST compliance at scale.

Our GST API enables automated GSTIN validation, e-Invoice & e-Waybill processing, return status tracking and reconciliation — reducing manual effort & compliance errors.

Real-time GSTIN verification to prevent invalid invoicing.

Auto-generate IRN-compliant e-Invoices and capture QR data.

Create and manage e-Waybills programmatically for consignments.

Auto-match purchase & sales with GSTR2A/2B to simplify returns.

Instant callbacks for IRN, filing and payment events.

Full analytics, audit logs & downloadable compliance reports.