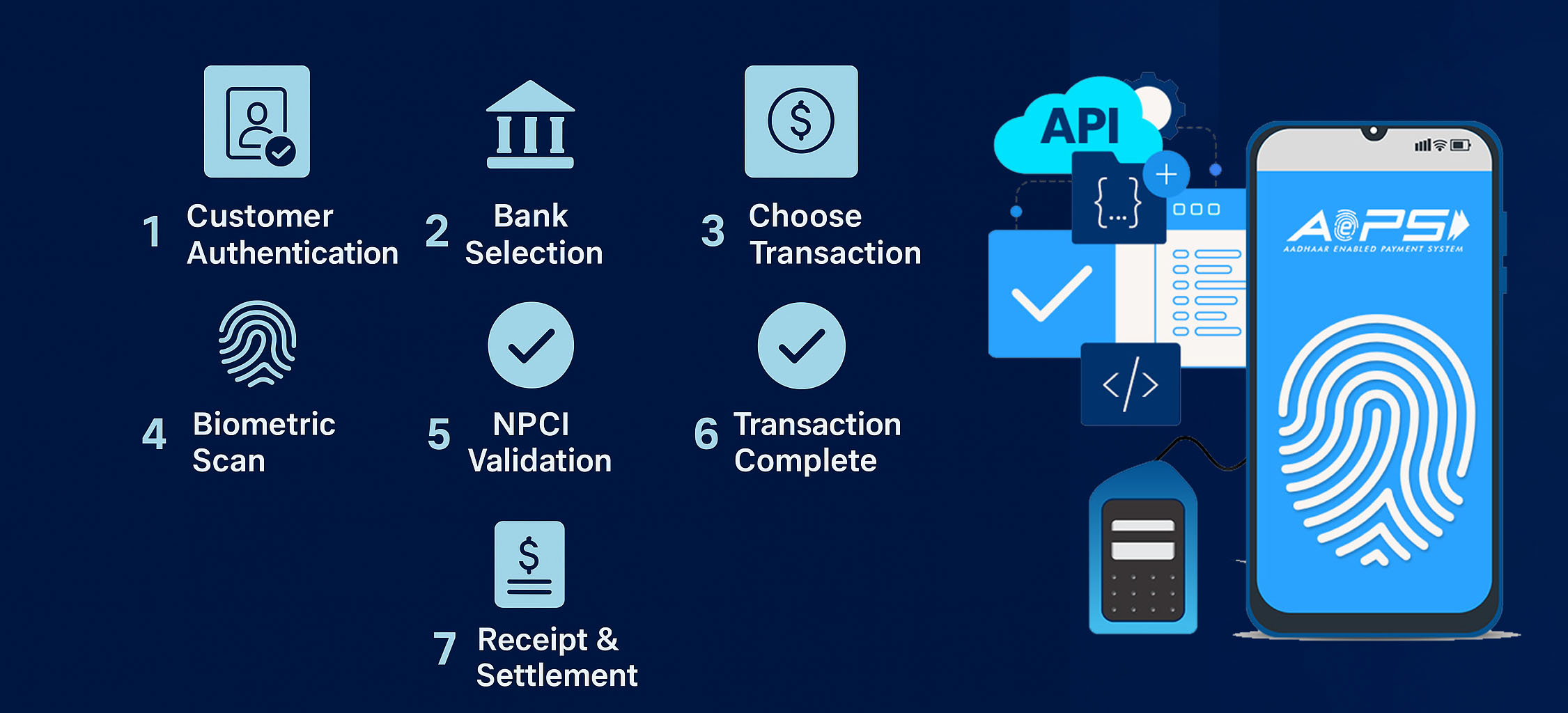

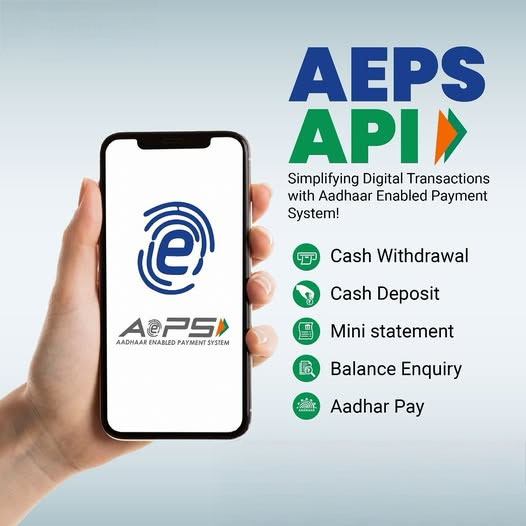

AEPS (Aadhaar Enabled Payment System) API enables secure, biometric-based financial transactions using Aadhaar authentication — without visiting a bank branch. Ideal for retailers, distributors and fintech businesses.

Using fingerprint or IRIS scan, customers can access essential banking services with instant response time and the highest transaction success rate.

AEPS allows secure, Aadhaar-based financial transactions in rural & semi-urban areas where banking infrastructure is limited.

Our AEPS API enables secure Aadhaar-based banking services using NPCI’s Aadhaar Enabled Payment System. It is designed for retailers, CSPs, micro-ATMs, BC agents and fintech businesses to offer essential financial services to customers instantly.

Fingerprint & IRIS-based KYC validation.

Built using NPCI-approved AEPS framework for accuracy.

Instant transaction success/failure updates.

Supports Mantra, Morpho, SecuGen & Startek devices.

Transactions settled quickly & securely.

Full analytics, reports & transaction management.